Amid a fog of sanctions: tracking down wheat and oil Russian exports

Patricia Martínez Sastre

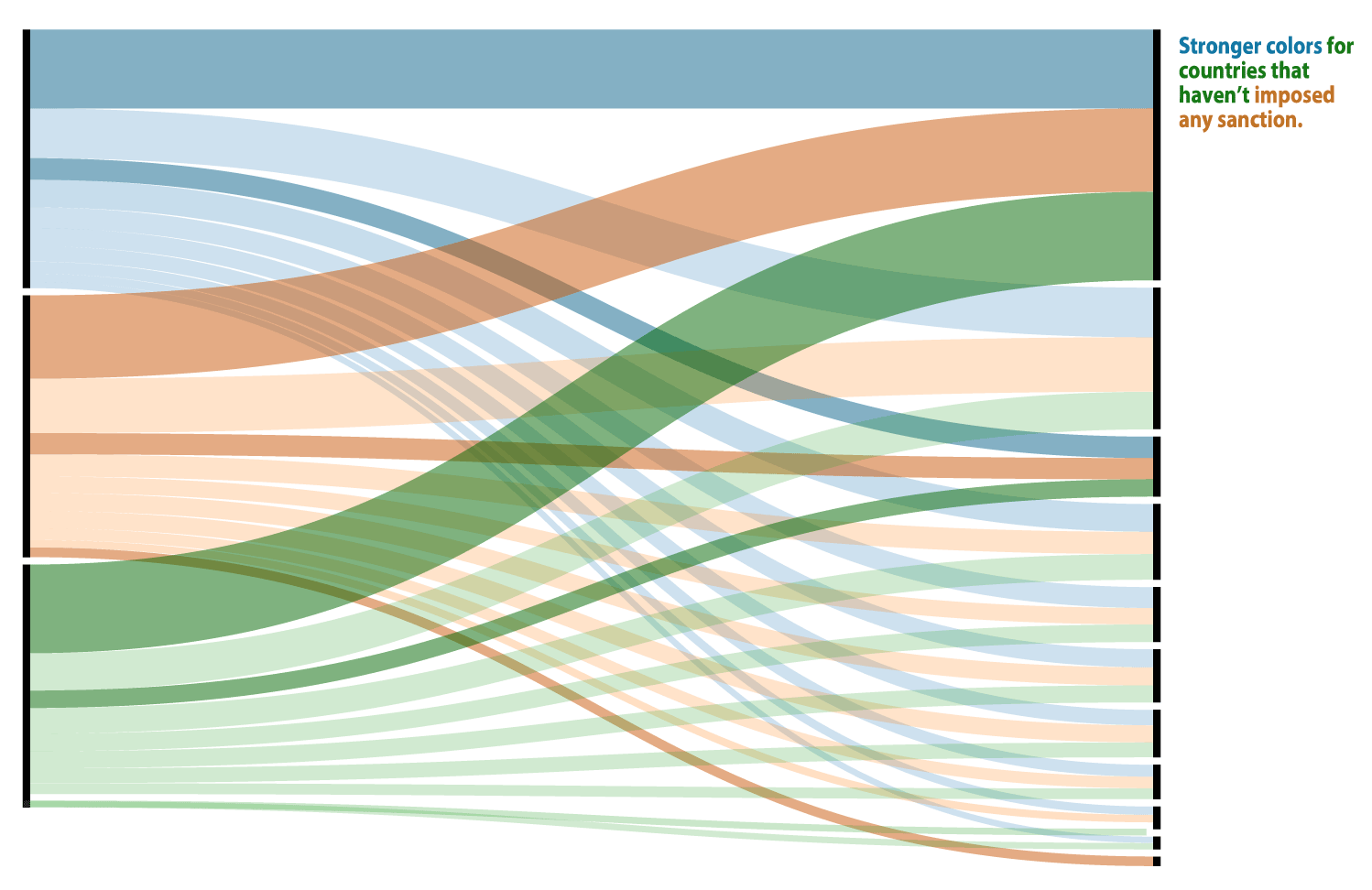

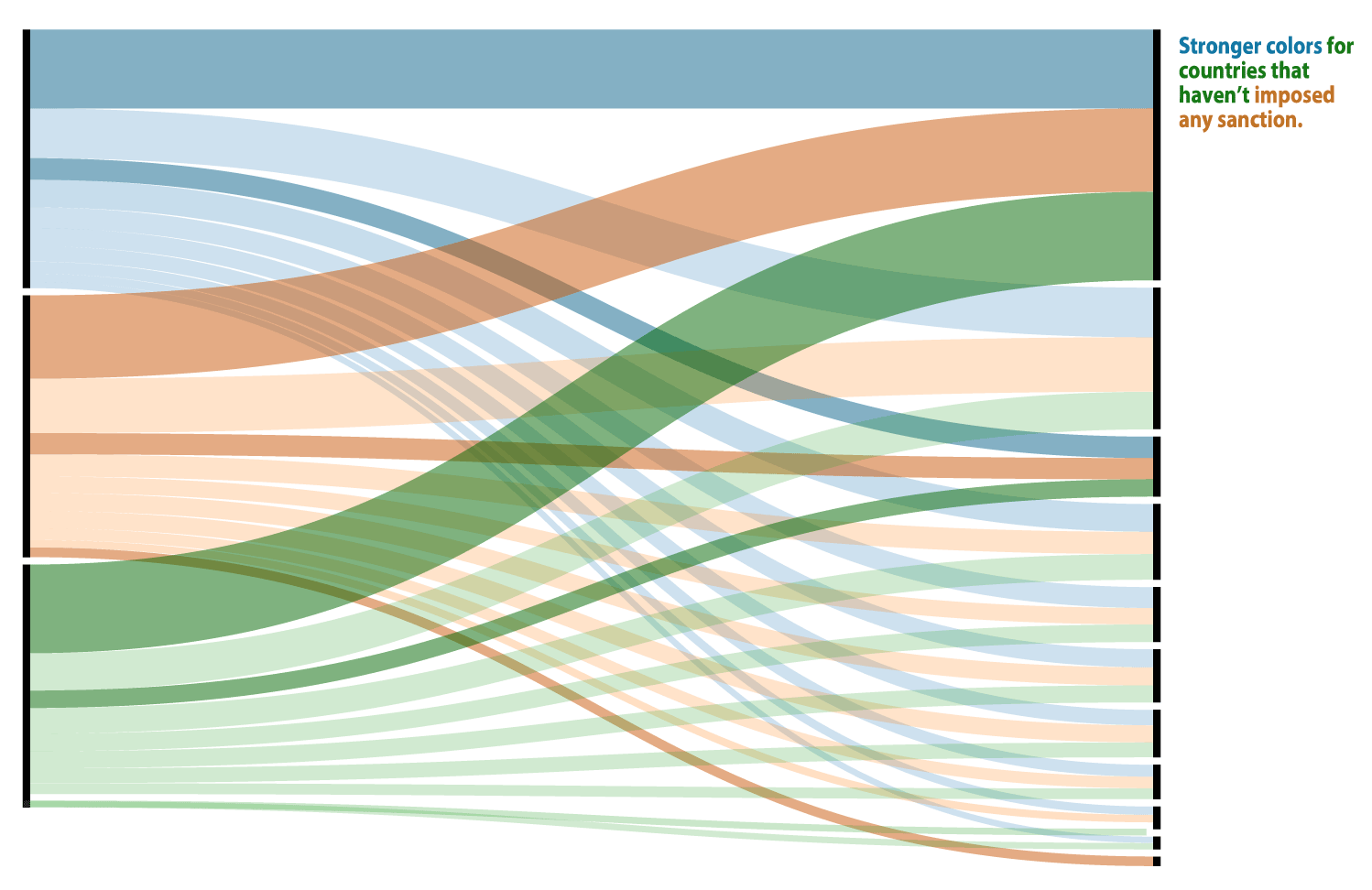

While U.S. and British bans on Russian oil increase the pressure on Europe to follow suit,

the continent’s dependence on Russia for energy makes an immediate embargo much more difficult.

Nevertheless, just US and British oil sanction can't be really effective by themselves, as most Russian

oil goes to China and European nations.

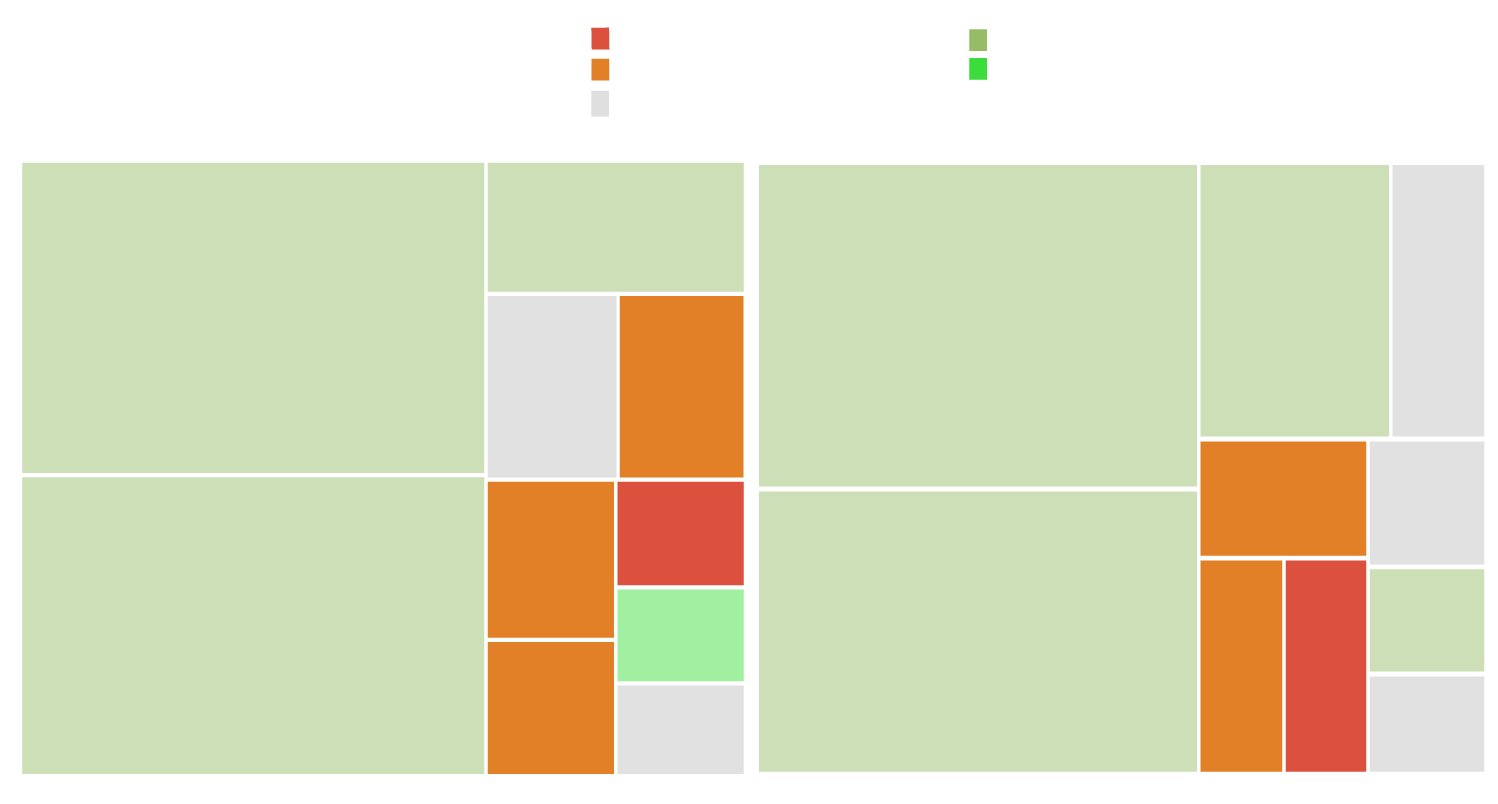

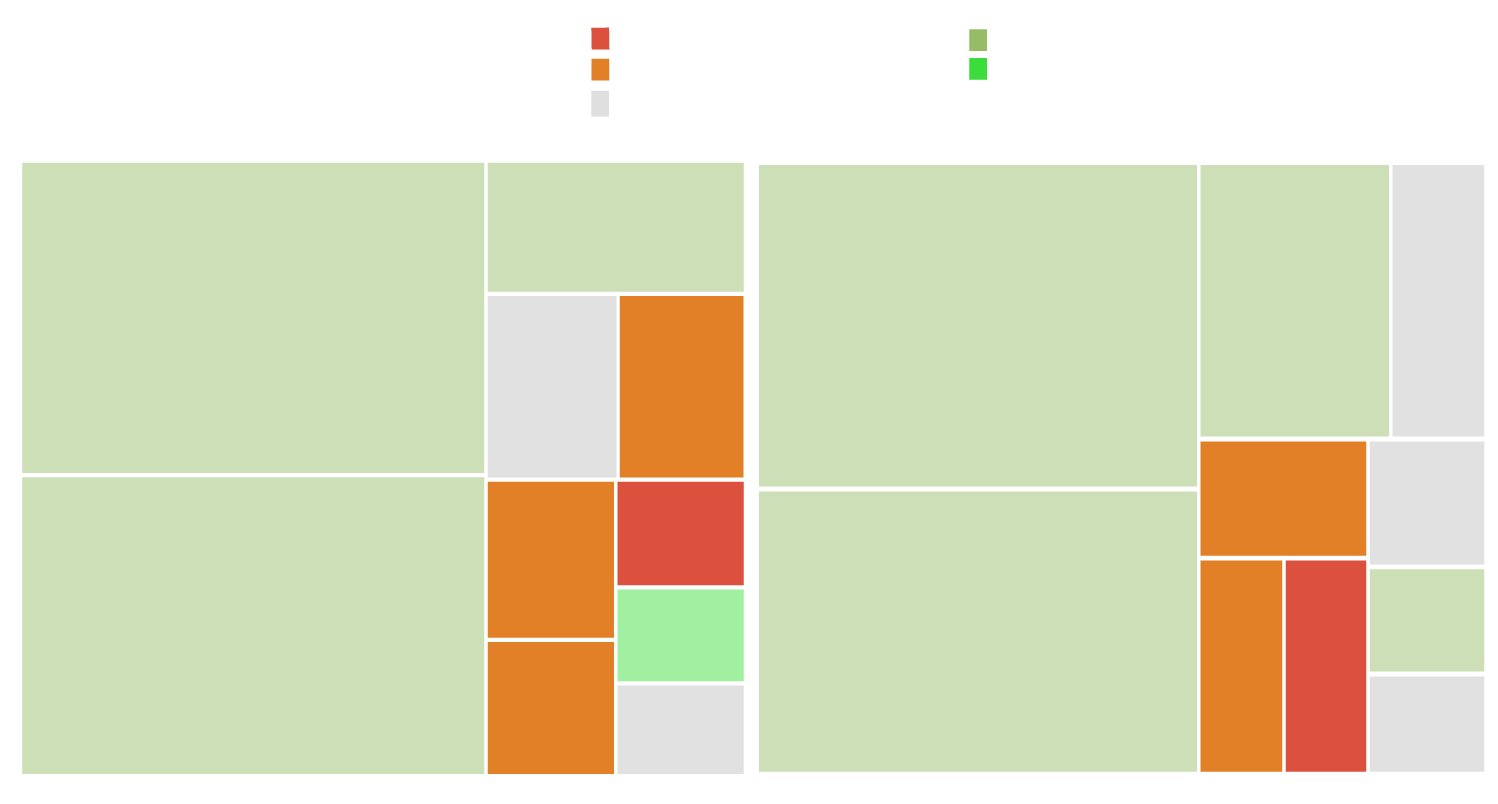

If we look at recent data, China is the top country to which Russia exports petrol: more than 1.5 million barrels per day

in 2020, according to data from UN Comtrate. The Netherlands sums the second largest figure (640,000 barrels per day), followed closely by Germany.

Dutch Prime minister Mark Rutte has rejected calls for a ban because it would have ‘enormous consequences’, a vision shared by

German Chancellor Olaf Scholz.

4.8 million barrels per day, where does Russia’s oil go?

Countries not backing sanctions against Russia add up 1.9 million

China

2018

more than 1.5 million

barrels per day

Netherlands

640,000

barrels/day

2019

297,000

Belarus

barrels/day

Germany

Poland

300,000

barrels/day

Rep. of Korea

2020

Italy

186,000

Finland

barrels/day

Japan

Slovakia

Turkey

2020

2019

2018

Rep. of Korea

Netherlands

Germany

Slovakia

Belarus

Finland

Poland

Turkey

China

Japan

Italy

over 1.5 million

barrels per day

186,000

297,000

640,000

300,000

China

2018

more than 1.5 million

barrels per day

Netherlands

640,000

barrels/day

2019

297,000

Belarus

barrels/day

Germany

Poland

300,000

barrels/day

Rep. of Korea

2020

Italy

186,000

Finland

barrels/day

Japan

Slovakia

Turkey

2020

2019

2018

Rep. of Korea

Netherlands

Germany

Slovakia

Belarus

Finland

Poland

Turkey

China

Japan

Italy

over 1.5 million

barrels per day

186,000

297,000

640,000

300,000

“Europe has deliberately exempted energy supplies from Russia from sanctions," Scholz said in a statement, adding: "At the moment,

Europe's supply of energy for heat generation, mobility, power supply and industry cannot be secured in any other way".

Belarus, the third most important partner and Russia's ally hasn't backed any sanction. On the contrary, the European Union

has effectively banned about 70% of all imports from that country, the EU said on Wednesday.

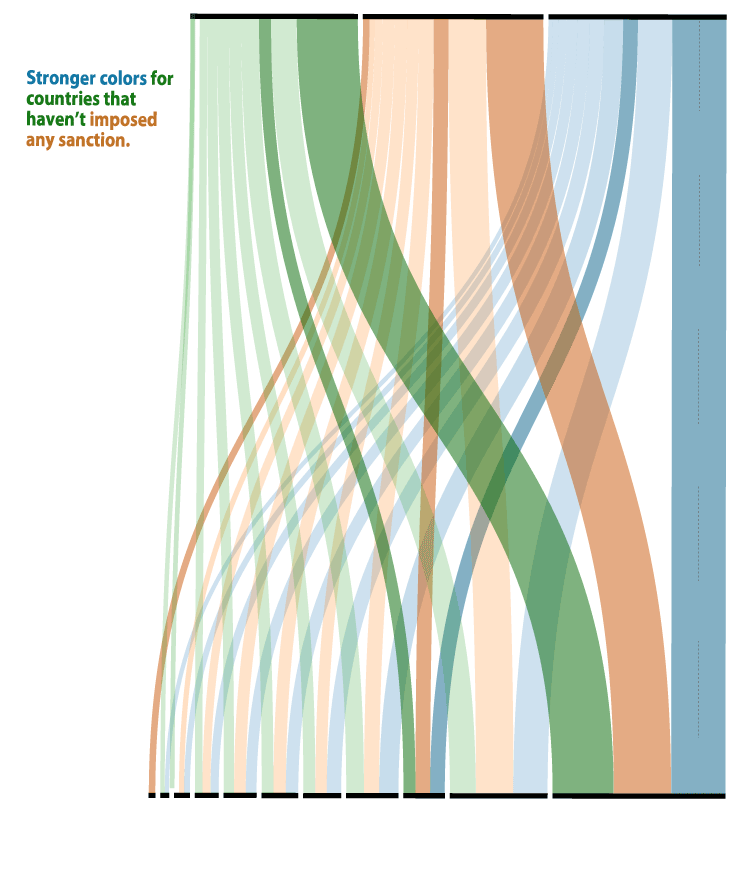

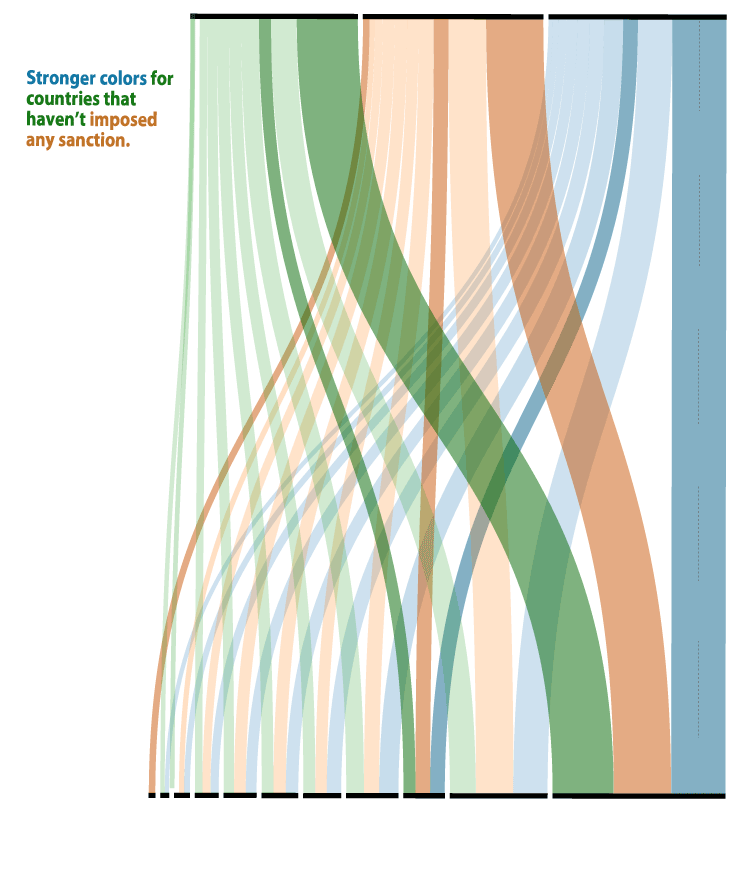

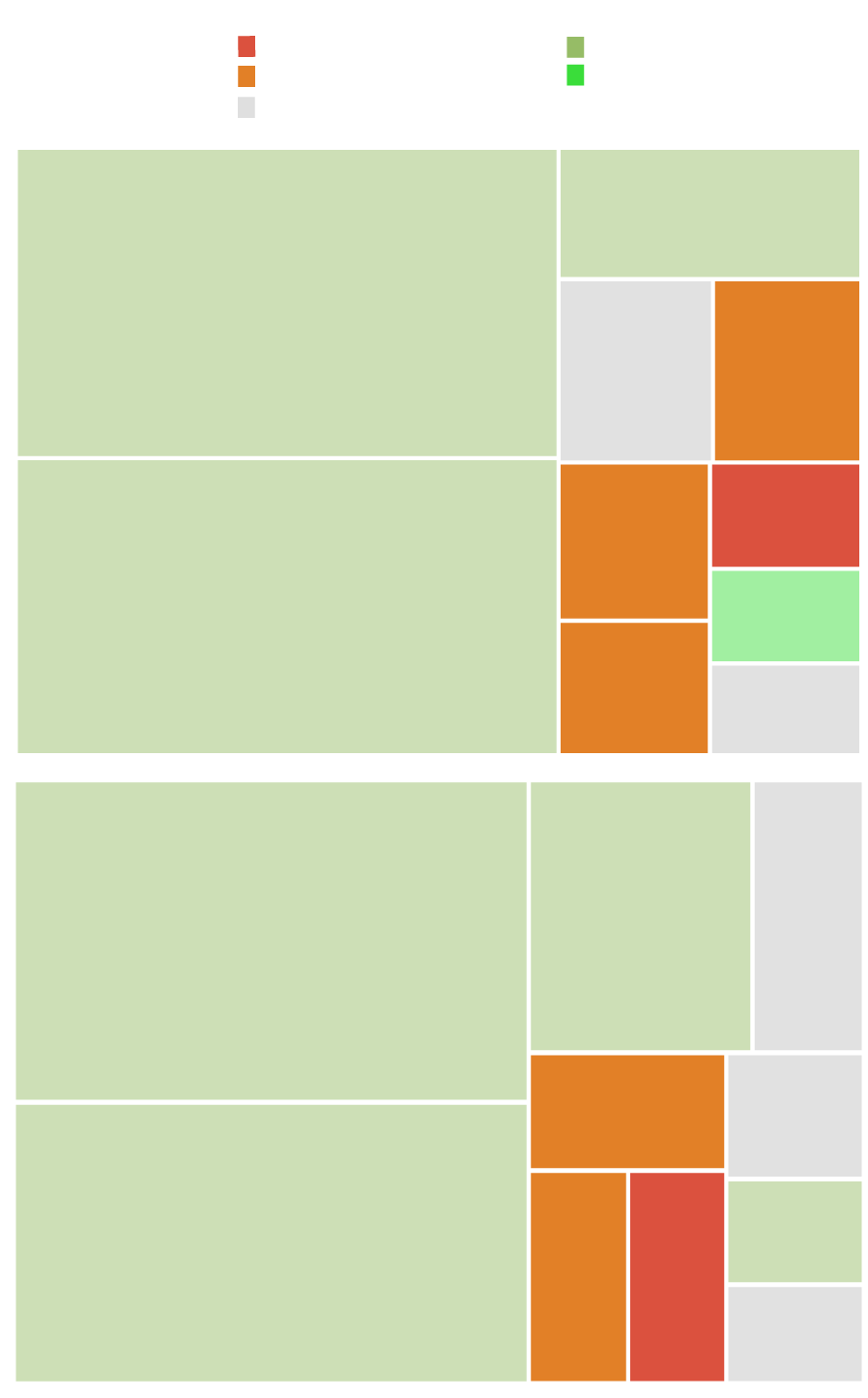

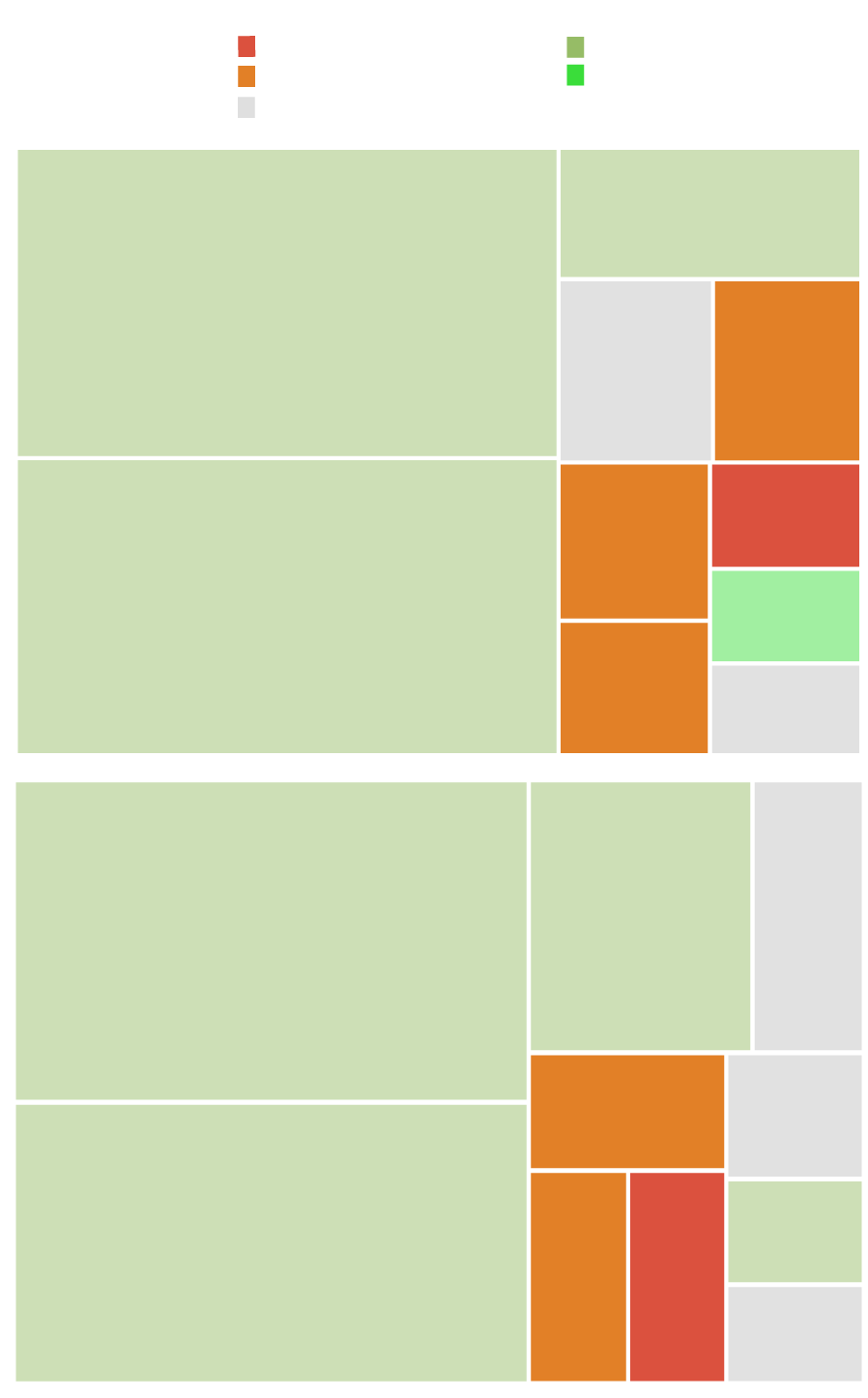

Disruption of Russian wheat exports could hit Yemen, Sudan

Concerns are also growing across the Middle East, North and Central Africa that the war in Ukraine will send prices of staple foods soaring as

wheat supplies are hit, potentially fuelling unrest. Russia and Ukraine supply a quarter of the world’s wheat exports, while Egypt is the world’s

biggest importer of wheat.

Looking at data from the UN Comtrade dataset, Turkey and Egypt are the nations where Russia exports most of its wheat, with over 8 million metric

tonnes and 7.9M, respectively, in 2020. There are also smaller nations like Yemen that buy less wheat, but where its disruption could have severe

consequences on their populations well-being.

The war will worsen food insecurity in vulnerable

countries like Yemen, Nigeria

Top 10 nations where Russia exports most of its wheat

Very High above (40%)

Prevalence of insufficient

food consumption

Moderately Low (10% - 20%)

Low (5% - 10%)

Moderately High (20% - 30%)

Not reported

2020

2019

Bangladesh

Azerbaijan

1,94

Turkey

Bangladesh

Egypt

7,03

2,58

1,28

8,25

million metric tonnes

Azerbaijan

Sudan

1,38

1,33

United Arab

Sudan

Emirates

Yemen

986,95

736,156

Pakistan

796,10

1,17

Viet Nam

Tanzania

Egypt

Turkey

604,543

700,911

Nigeria

Yemen

6,13

Nigeria

7,90

880,507

894,72

United Arab

Latvia

998,13

Emirates

578,806

674,558

Prevalence of

insufficient food

consumption

Very High above (40%)

Moderately Low (10% - 20%)

Moderately High (20% - 30%)

Low (5% - 10%)

Not reported

2020

Bangladesh

1,94

Egypt

8,25 million metric tonnes

Azerbaijan

Sudan

1,38

1,33

Yemen

Pakistan

796,10

1,17

Tanzania

Turkey

700,911

Nigeria

7,90

United Arab

998,13

Emirates

674,558

2019

Azerbaijan

Turkey

Bangladesh

7,03

2,58

1,28

United Arab

Sudan

Emirates

986,95

736,156

Viet Nam

Egypt

604,543

Nigeria

Yemen

6,13

894,72

880,507

Latvia

578,806

Very High above (40%)

Prevalence of insufficient

food consumption

Moderately Low (10% - 20%)

Low (5% - 10%)

Moderately High (20% - 30%)

Not reported

2020

2019

Bangladesh

Azerbaijan

1,94

Turkey

Bangladesh

Egypt

7,03

2,58

1,28

8,25

million metric tonnes

Azerbaijan

Sudan

1,38

1,33

United Arab

Sudan

Emirates

Yemen

986,95

736,156

Pakistan

796,10

1,17

Viet Nam

Tanzania

Egypt

Turkey

604,543

700,911

Nigeria

Yemen

6,13

Nigeria

7,90

880,507

894,72

United Arab

Latvia

998,13

Emirates

578,806

674,558

Prevalence of

insufficient food

consumption

Very High above (40%)

Moderately Low (10% - 20%)

Moderately High (20% - 30%)

Low (5% - 10%)

Not reported

2020

Bangladesh

1,94

Egypt

8,25 million metric tonnes

Azerbaijan

Sudan

1,38

1,33

Yemen

Pakistan

796,10

1,17

Tanzania

Turkey

700,911

Nigeria

7,90

United Arab

998,13

Emirates

674,558

2019

Azerbaijan

Turkey

Bangladesh

7,03

2,58

1,28

United Arab

Sudan

Emirates

986,95

736,156

Viet Nam

Egypt

604,543

Nigeria

Yemen

6,13

894,72

880,507

Latvia

578,806

More than a third of the wheat Yemen consumes comes from Russia and Ukraine. The country has been ravaged by war since 2014, and a simple staple

like bread makes up over half of the calorie intake for the average household. According to the World Food Programme (WFP) estimations on food insecurity,

there are four countries heavily dependent on Russian wheat where insufficient food consumption affects at least 20% of their population.

That is the current situation in Sudan, Nigeria and Pakistan, all on them reliant on Russian and Ukranian wheat. In the case of Yemen, more than 40% of its

almost 30 million inhabitants already suffer food scarcity. A sudden rise on the price of this essential commodity could have a devastating effect.